DEBANKING SPREE: UK banks are closing more than 1,000 accounts a day with little explanation

08/07/2023 / By Arsenio Toledo

Banks in the United Kingdom are closing more than 1,000 accounts every working day.

The figures come from an audit conducted by the Financial Conduct Authority, the U.K.’s main financial regulatory body, and published through a freedom of information request. The audit found that just over 45,000 accounts were shut down by banks from 2016 to 2017, amounting to around 170 accounts shut down per business day.

The number of bank accounts being shut down has surged since then, climbing to over 343,000 accounts in 2021 to 2022 – or well over 1,000 accounts per business day of the week. (Related: British banks are now closing the accounts of clients they don’t politically agree with.)

“They are coming for your bank account, my friends,” warned Josh Sigurdson of “World Alternative Media.”

“Banks are shutting down up to 1,000 accounts a day … children are now being denied bank accounts because of their parents’ political involvement, which is insane,” Sigurdson further warned. “We are in a world of hurt if we, as individuals, do not stand up to this today because your bank account will be shut down eventually for ‘wrong think.'”

British media have previously reported that when bank accounts get closed, the individuals or organizations owning the accounts get little or no explanation as to why. Banks can release statements at certain times for why certain public individuals or organizations shut down, but these statements will only be made regularly for shutdown accounts allegedly involved in financial crimes.

Nearly 100,000 bank accounts marked for belonging to “politically exposed persons”

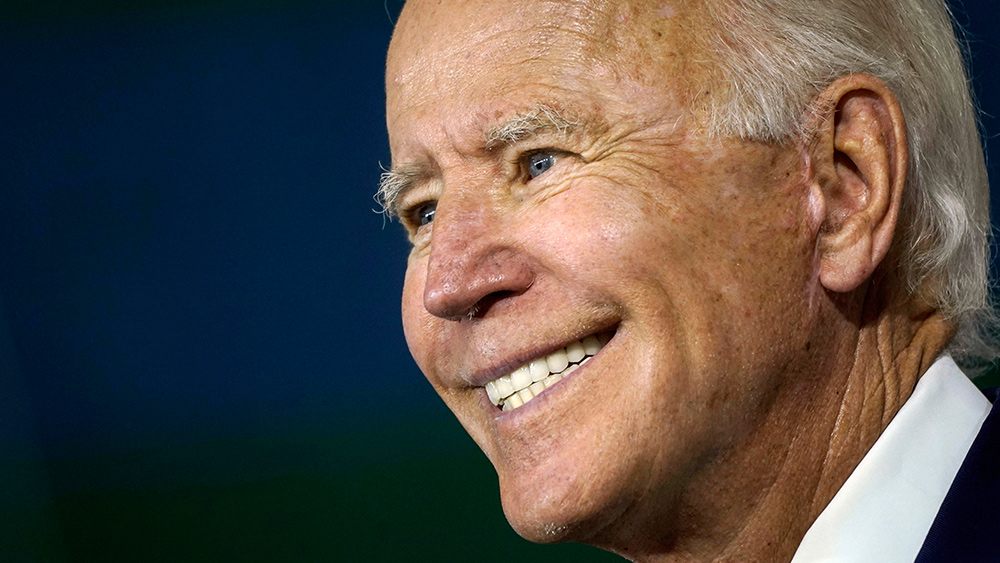

U.K. politician and pro-Brexit advocate Nigel Farage, who in late June went public to the British press about his experience being debanked by British bank Coutts, noted that he used a subject access request to discover that, despite initial denials by Coutts and its parent company NatWest, his political views did in fact play a part in the closure of his account.

Furthermore, an investigation led by Farage found that almost 90,000 individuals are estimated to have been categorized as “politically exposed persons” by British banks. These include members of parliament and other political figures and activists deemed to be at risk of abusing their positions for private gain and who require extra checks.

Other figures from the Financial Ombudsman Service show that NatWest – which is 39 percent owned by British taxpayers – had the joint highest number of complaints about unilateral decisions to close bank accounts last year, joining British banking conglomerate Barclays.

To resolve the debanking issues, Farage said he would like to see a royal commission set up to examine the problem, “provided it happened quickly.” Other conservatives have rallied around Farage, adding weight to his call to hold British banks accountable.

“I’ve just been inundated by small businesses, by folk all around the country,” said Farage. “People in absolute fear, terror, lives being ruined, thousands of businesses being closed. These are people who have done nothing wrong whatsoever.”

Learn more about the debanking crisis unfolding in Britain at FinanceRiot.com.

Watch this episode of “World Alternative Media” as host Josh Sigurdson is joined by financial expert Tim Picciott, the Liberty Advisor, to discuss the more than 1,000 bank accounts being shut down every day for political views.

This video is from the World Alternative Media channel on Brighteon.com.

More related stories:

Children now being denied bank accounts because of their parents’ political involvement.

British banks that canceled conservatives could lose their licenses.

WEAPONIZED BANKING: Big UK bank freezes Nigel Farage’s accounts.

Sources include:

Submit a correction >>

Tagged Under:

bank accounts, banking, banks, biased, Big Banks, conspiracy, Coutts, debanking, finance, finance riot, financial crash, NatWest, nigel farage, political correctness, politics, United Kingdom

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 INSANITY NEWS